Problem: Managing vast financial data and making precise decisions quickly has always been a challenge, often leading to missed opportunities or costly errors.

Agitate: Traditional methods, limited by human capabilities and time constraints, struggle to keep pace with the speed and complexity of modern financial markets. This results in inefficiencies, increased risks, and a competitive disadvantage for businesses.

Solution: Enter artificial intelligence—a transformative force. In this article, we’ll explore how AI addresses these challenges, reshaping finance with unprecedented speed, accuracy, and insights.

What Is AI in Finance?

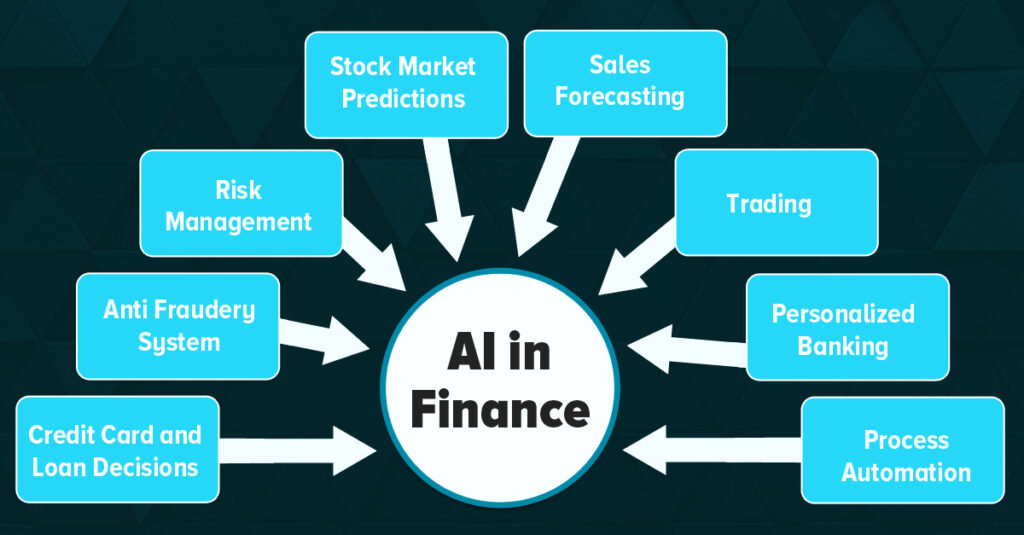

AI in finance refers to the application of artificial intelligence technologies such as machine learning, natural language processing, and robotics to enhance decision-making, automate processes, and analyze financial data with greater precision.

This technology enables financial institutions to perform tasks that once required significant human effort, such as fraud detection, risk assessment, and customer service, at a speed and scale that are otherwise unattainable.

At its core, AI in finance leverages algorithms to uncover patterns and insights in massive datasets. For instance, machine learning models can identify spending trends, predict market fluctuations, or evaluate creditworthiness based on historical data.

These capabilities allow businesses to minimize risks, optimize operations, and provide highly personalized financial solutions to clients.

The scope of AI in finance spans a wide range of applications. In investment management, AI systems analyze real-time market data to make predictions that guide trading strategies. In banking, AI chatbots and virtual assistants enhance customer service by resolving queries instantly.

Meanwhile, credit underwriting has become more accurate as AI evaluates borrower profiles using a broader spectrum of non-traditional data points, such as online behavior or digital footprints.

One major advantage of AI in finance is its ability to adapt and learn over time. Unlike traditional models, which rely on static algorithms, AI systems improve their accuracy and efficiency as they process new data.

For example, fraud detection systems powered by AI continuously evolve to identify new patterns of suspicious behavior, reducing false positives and protecting both businesses and consumers.

However, the adoption of AI in finance comes with its challenges. Ensuring data privacy and meeting regulatory standards are significant hurdles for financial institutions. Additionally, the reliance on AI models necessitates careful oversight, as biases in data or algorithms can lead to unfair outcomes or missed opportunities.

Despite these obstacles, the benefits of AI far outweigh the drawbacks, making it an indispensable tool for modern finance.

In conclusion, AI in finance represents a transformative shift in how financial services operate. By harnessing advanced technologies, businesses can achieve unparalleled efficiency, accuracy, and customer satisfaction. This evolution not only addresses long-standing challenges in the industry but also paves the way for innovative solutions that redefine the future of finance.

Top Benefits of AI in Finance

Enhanced Decision-Making

AI enables financial institutions to process vast amounts of data quickly, providing actionable insights. Machine learning models analyze market trends and predict future scenarios with high accuracy. This capability supports better investment strategies, risk assessments, and overall decision-making, leading to increased profitability.Improved Fraud Detection

AI systems use advanced algorithms to identify unusual patterns in transactions, flagging potentially fraudulent activities. Unlike traditional systems, AI continuously learns and adapts to emerging fraud tactics, reducing false alarms and protecting businesses and customers from financial losses.Cost Efficiency

By automating routine tasks like data entry, compliance checks, and reporting, AI significantly reduces operational costs. Processes that traditionally required human intervention can now be completed faster and more accurately, freeing up resources for more strategic activities.Personalized Customer Experiences

AI tools analyze individual customer data to offer tailored financial advice and product recommendations. This personalization fosters stronger customer relationships, increases satisfaction, and improves retention rates. Chatbots and virtual assistants powered by AI further enhance service quality by providing instant, accurate responses.Risk Management

AI excels in analyzing and predicting risks, enabling businesses to prepare for potential disruptions. It can evaluate market conditions, simulate stress scenarios, and provide recommendations to mitigate risks, ensuring better resilience during economic volatility.Real-Time Analytics

AI delivers real-time insights, allowing businesses to respond swiftly to changing conditions. For example, traders can use AI-powered platforms to monitor stock performance and make instant adjustments to portfolios, capitalizing on market opportunities.Streamlined Compliance

Regulatory compliance is a critical concern in finance. AI simplifies this process by automatically monitoring transactions, identifying regulatory risks, and generating reports that align with industry standards. This reduces the burden on compliance teams and minimizes errors.Accessibility to Advanced Tools

AI democratizes access to sophisticated financial tools, enabling small and medium-sized businesses to compete with larger institutions. For instance, automated accounting software and investment platforms powered by AI are now available at affordable rates, leveling the playing field.Enhanced Predictive Analytics

AI systems use predictive models to forecast market trends, customer behavior, and credit risks. These insights help businesses make proactive decisions, optimize resources, and stay ahead of competitors.Scalability and Flexibility

AI solutions are highly scalable, accommodating growth without requiring significant additional investments. Businesses can integrate AI tools into their existing systems and adapt them as their needs evolve, ensuring long-term value and sustainability.

Incorporating AI in finance brings transformative benefits, driving efficiency, accuracy, and growth. For businesses looking to gain a competitive edge, embracing these technologies is no longer optional—it’s essential.

The Power of AI in Finance and Algorithmic Trading

AI is transforming the finance industry by enabling faster, more accurate decision-making and enhancing processes like algorithmic trading, risk assessment, and customer behavior analysis. AI systems use machine learning models to analyze vast amounts of data, predict trends, and automate tasks, creating efficiencies and improving accuracy in ways traditional methods cannot match.

For instance, supervised learning models can forecast consumer or creditor behaviors, while reinforcement learning optimizes trading algorithms based on performance feedback.

AI's use in finance includes:

- Algorithmic Trading: By processing historical and real-time data, AI enhances trading strategies, though it requires safeguards like stop-loss mechanisms to mitigate risks in volatile markets.

- Risk Management: AI tools assess market conditions and identify potential risks during events like market crashes, enabling businesses to adapt swiftly.

- Personalized Services: AI-powered systems tailor financial products and advice to individual customers by analyzing behavioral data.

However, human oversight remains crucial to ensure ethical practices and manage AI systems, especially during unpredictable events like black swan occurrences. Tools like Python, TensorFlow, and pandas are integral to building these AI systems, lowering entry barriers for developers and financial professionals.

1. How is AI transforming the role of financial analysts?

AI is augmenting the role of financial analysts by automating repetitive tasks such as data collection, report generation, and basic trend analysis. This allows analysts to focus on interpreting data, developing strategies, and providing insights that require human judgment. AI tools also enable analysts to process vast datasets more quickly, improving accuracy and decision-making.

2. Are there ethical concerns associated with using AI in finance?

Yes, there are ethical concerns, including biases in AI algorithms, data privacy issues, and potential job displacement. Biases can arise if the AI models are trained on unrepresentative data, leading to unfair outcomes in areas like credit approvals. Additionally, financial institutions must ensure customer data is used responsibly and comply with privacy regulations. Addressing these challenges requires transparency, robust oversight, and continuous evaluation of AI systems.

3. Can small businesses benefit from AI in finance?

Absolutely. AI tools are increasingly accessible to small businesses, offering solutions for budgeting, expense tracking, and cash flow forecasting. Platforms like AI-driven accounting software or chatbot-based customer support can streamline operations without requiring significant financial investment. This helps small businesses save time, reduce costs, and make informed decisions.

4. How secure are AI-driven financial systems?

AI-driven financial systems are generally designed with strong security protocols, including encryption and real-time threat detection. However, like any technology, they are not immune to cyberattacks. Businesses must adopt additional measures, such as regular updates, multi-factor authentication, and periodic security audits, to protect sensitive financial data.

5. How can AI help improve financial inclusion?

AI can expand financial inclusion by analyzing alternative data sources, such as mobile payment records or social media activity, to assess creditworthiness for individuals without traditional credit histories. This approach enables underserved populations to access financial services like loans, insurance, and investments. AI-powered chatbots and mobile apps also make banking services more accessible to remote and rural areas.

If you want to know The Top Cybersecurity Practices for Financial Institutions, Then Click Here.