In a world where financial institutions are prime targets for cybercriminals, data security is not just a best practice—it’s a necessity. Banks, investment firms, and other financial entities handle vast amounts of sensitive data daily.

From account details to transaction histories, any breach can result in catastrophic losses, erode trust, and trigger compliance violations. As the digital landscape evolves, it is critical for financial institutions to stay ahead with cybersecurity best practices to prevent risks from internal and external threats.

This guide explores the top strategies that financial institutions need to adopt to keep their data secure, ensuring robust cyber risk management strategies are in place.

1. Understanding the Risks: Why Cybersecurity Matters for Financial Institutions

The financial sector faces multiple cyber threats, ranging from phishing attacks and ransomware to insider threats. Financial institutions aren’t just lucrative targets—they’re also regulated heavily, making them accountable for protecting customer data. A security breach can trigger fines, lawsuits, and a loss of reputation.

Common Cyber Threats in the Financial Sector

Phishing protection for banks: Criminals trick employees or customers into revealing sensitive information.

Mitigating insider threats in finance: Rogue employees or careless actions can cause severe damage.

Cloud security for financial institutions: Misconfigured cloud systems expose data to cyber risks.

This makes it essential for every institution to deploy proactive cyber risk management strategies and invest in cutting-edge security technologies.

2. Key Cybersecurity Best Practices for Financial Institutions

A strong cybersecurity framework ensures compliance with cybersecurity standards and provides a multi-layered defense against attacks. Here are some best practices every financial institution should adopt:

2.1 Multi-Factor Authentication and Access Control

Implementing access control systems for banks ensures only authorized personnel can access sensitive data. This minimizes the chances of data breaches caused by unauthorized access. Additionally, multi-factor authentication provides an added layer of security, especially for remote access.

2.2 Employee Awareness Programs

Since phishing remains a significant threat, regular phishing protection for banks training ensures employees can recognize fraudulent emails and avoid falling victim. Awareness programs empower staff to become the first line of defense against cyber threats.

2.3 Encryption and Cloud Security Measures

Data encryption helps secure both stored and transmitted information. With many institutions adopting cloud solutions, it’s crucial to implement cloud security for financial institutions that addresses vulnerabilities specific to cloud-based systems.

3. Advanced Tools for Cyber Risk Management

Financial institutions must leverage the right tools to fortify their defenses. Apart from firewalls and intrusion detection systems, modern cybersecurity strategies include:

Compliance cybersecurity for financial institutions: Ensuring all systems adhere to the latest regulations and industry standards.

Cyber insurance for the financial industry: Provides a safety net in case of a cyber attack, reducing financial liability.

Access control systems for banks: Ensures only legitimate users can interact with critical systems.

These strategies not only protect from external threats but also assist in mitigating insider threats in finance.

4. Why VPNs Are Essential for Financial Institutions

In today’s connected world, remote work is increasingly becoming the norm. Employees, contractors, or even third-party vendors may need to access a financial institution’s internal systems remotely. This is where VPNs (Virtual Private Networks) become indispensable.

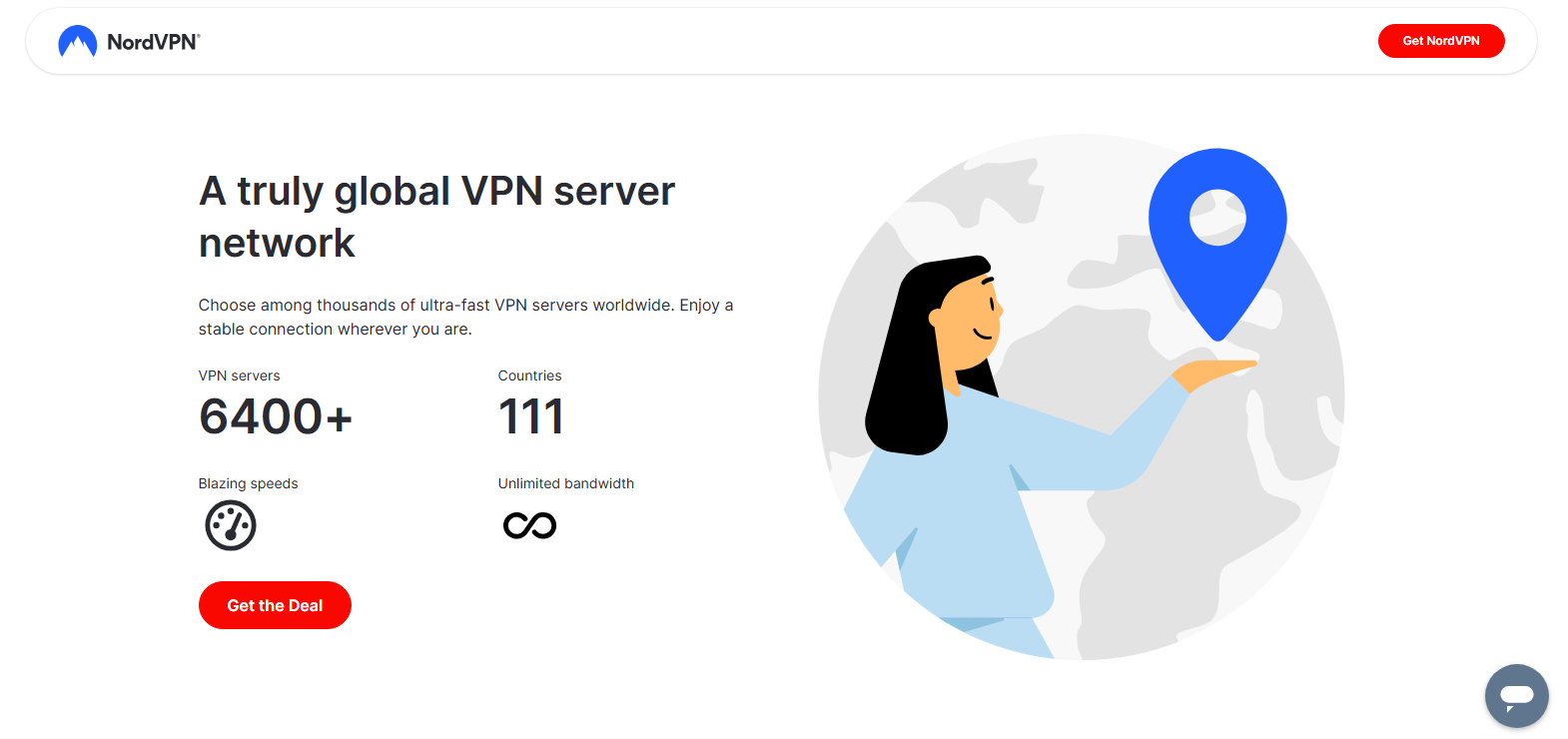

NordVPN: The Smart Choice for Financial Data Security

When it comes to securing remote access, not all VPNs are created equal. NordVPN stands out as a top-tier solution for financial institutions, offering advanced encryption, a no-logs policy, and reliable performance. Here’s why NordVPN is a must-have for your business:

End-to-end encryption ensures that all transmitted data remains secure, preventing unauthorized access.

Cloud-friendly integration makes it easy for businesses using cloud systems to maintain compliance.

Access control support allows institutions to monitor and control who connects to the internal network remotely.

Prevents phishing attacks by blocking malicious websites and protecting employees working remotely from compromised networks.

For institutions aiming to protect their data and minimize cybersecurity risks, NordVPN offers the perfect blend of security and efficiency.

Add NordVPN to your cybersecurity toolkit today to stay ahead of evolving cyber threats. Use the secure remote access solution from NordVPN to ensure your data is always protected. Find out more about NordVPN for businesses and safeguard your financial institution against future threats!

Conclusion

The financial sector cannot afford to take cybersecurity lightly. Implementing cybersecurity best practices for the financial sector—such as multi-factor authentication, phishing awareness, and VPN solutions—can make all the difference between security and vulnerability.

As the digital landscape evolves, staying updated with cyber risk management strategies is key to ensuring data security for banks. And with tools like NordVPN, financial institutions can add an extra layer of defense, ensuring their remote access systems are both secure and compliant.

Don't wait—NordVPN can help your financial institution stay protected in an unpredictable cyber landscape. Stay safe, stay ahead!

What are cyber risk management tools?

Cyber risk management tools are solutions designed to help organizations identify, assess, manage, and mitigate cybersecurity risks. These tools typically encompass a range of technologies and practices, including risk assessment frameworks, threat detection systems, and incident response protocols. By leveraging these tools, organizations can better safeguard their assets against cyber threats and ensure compliance with regulatory standards.

How do cyber risk management tools improve security posture?

Cyber risk management tools enhance an organization’s security posture by providing visibility into potential vulnerabilities and threats. For instance, tools such as Security Information and Event Management (SIEM) systems aggregate and analyze security data in real time, allowing for quicker identification of anomalies. Additionally, automated solutions such as Security Orchestration, Automation and Response (SOAR) streamline incident response processes, enabling teams to respond effectively to threats.

What types of tools are included in cyber risk management?

Cyber risk management tools encompass a variety of solutions, including but not limited to:

- Security Information and Event Management (SIEM): Monitors and analyzes security events from various sources.

- Endpoint Detection and Response (EDR): Focuses on detecting and responding to threats on endpoint devices.

- Vulnerability Management Tools: Identify and prioritize vulnerabilities in software and systems.

- Risk Assessment Frameworks: Provide structured approaches for evaluating risks and implementing mitigations.

- Incident Response Platforms: Facilitate the management and coordination of incident response activities.

How can organizations choose the right cyber risk management tools?

Selecting the right cyber risk management tools depends on an organization’s specific needs, existing security infrastructure, and risk profile. Organizations should evaluate tools based on their capabilities, ease of integration, scalability, and the level of support provided by vendors. Engaging in a thorough risk assessment can also help identify gaps in current security measures, guiding the selection process for appropriate tools.

What role does disaster recovery play in cyber risk management?

Disaster recovery is a critical component of cyber risk management, as it ensures business continuity in the event of a cyber incident. Effective disaster recovery solutions allow organizations to quickly restore operations by failing over to backup systems, reducing downtime and limiting the impacts of attacks such as ransomware. By integrating disaster recovery planning into their overall risk management strategy, organizations can enhance resilience against cyber threats.

Are there any emerging trends in cyber risk management tools?

Emerging trends in cyber risk management tools include the increasing use of artificial intelligence (AI) and machine learning to enhance threat detection and response capabilities. These technologies enable more accurate predictions of potential threats and automate response actions, significantly improving the efficiency of security operations. Additionally, there is a growing emphasis on compliance with frameworks such as NIST Cybersecurity Framework 2.0, which provides organizations with structured guidelines for managing cybersecurity risks effectively.

If you want to know How to Use Testimonials to Enhance Your Sales Funnel, Then Click Here.