In today’s digital age, protecting your personal and business finances from online threats is more important than ever. With cyberattacks becoming increasingly sophisticated, safeguarding your financial information requires a proactive approach.

Below are some highly effective tools and strategies to help you secure your finances from online fraud, hacking, and other cyber threats.

Whether you're running a small business or just managing your personal accounts, these tools will help keep your financial data out of the wrong hands.

1. Password Managers: Guard Your Accounts with Strong Passwords

Many people underestimate the power of a strong password. But with cybercriminals constantly evolving their methods, it’s essential to create and manage secure passwords.

Tools like LastPass, Dashlane, and 1Password help you generate complex passwords for every account, so you're not using the same password twice. These managers securely store your passwords, ensuring that you only need to remember one master password.

2. Two-Factor Authentication (2FA): Add an Extra Layer of Security

Even the strongest password isn’t foolproof, which is where two-factor authentication (2FA) comes into play. With 2FA, you’ll need to provide a second form of verification (like a code sent to your phone) to access your accounts.

Google Authenticator, Microsoft Authenticator, and Authy are popular tools that add an extra layer of security to your financial accounts.

3. Anti-Malware Software: Keep Your Devices Clean

Malware, including keyloggers and ransomware, can easily compromise your financial information. Tools like Malwarebytes, Norton, and Bitdefender offer real-time protection against malicious software.

By regularly scanning your devices, these tools can help keep your system free from infections, ensuring that your financial details aren’t at risk.

4. Secure Browsers and Extensions: Protect Your Online Activity

Your web browser is a gateway to the internet, so using a secure one is essential. Brave, Tor Browser, and even the HTTPS Everywhere extension help encrypt your web traffic and protect your online activity.

These tools prevent unauthorized parties from eavesdropping on your sensitive information, especially when you're managing finances or making online transactions.

5. Encryption Tools: Safeguard Your Financial Data

Whether you're transferring sensitive data between devices or storing financial documents, encryption is your friend. Tools like VeraCrypt and AxCrypt allow you to encrypt files, ensuring only authorized individuals can access them.

Encryption transforms your data into a format that is unreadable without the proper key, providing you with peace of mind.

6. Financial Monitoring Services: Get Alerts on Suspicious Activity

To proactively protect your finances, it’s a good idea to invest in a financial monitoring service. Services like LifeLock, IdentityForce, and Experian track your credit report and send you alerts if suspicious activity is detected.

These tools help prevent identity theft and unauthorized transactions from slipping under the radar, enabling you to act quickly if something goes wrong.

7. NordVPN: Secure Your Connection and Encrypt Your Financial Transactions

With more financial transactions happening online, securing your internet connection is a must. NordVPN is an essential tool that encrypts your online activity, including any financial transactions.

When you’re using banking apps or managing business accounts, a VPN protects you by creating an encrypted tunnel between your device and the server, making it impossible for hackers to intercept your data.

Whether you're at home or on public Wi-Fi, NordVPN ensures your sensitive information stays private.

The Benefits of Using NordVPN

When it comes to protecting your financial information online, NordVPN offers several benefits that make it stand out. It doesn’t just keep your internet connection secure; it also protects you from cybercriminals trying to steal your sensitive data.

1. Advanced Encryption:

NordVPN uses top-tier encryption to secure your online transactions, ensuring that your financial information remains private, even on public networks.

2. No-Log Policy:

Your online activities are your own business. With NordVPN's strict no-log policy, none of your browsing data is stored or shared.

3. Protection on Public Wi-Fi:

Whether you're at a café, airport, or hotel, NordVPN keeps your data safe on unsecured public Wi-Fi networks.

4. Global Coverage:

With thousands of servers in over 60 countries, NordVPN ensures a fast, secure connection no matter where you are.

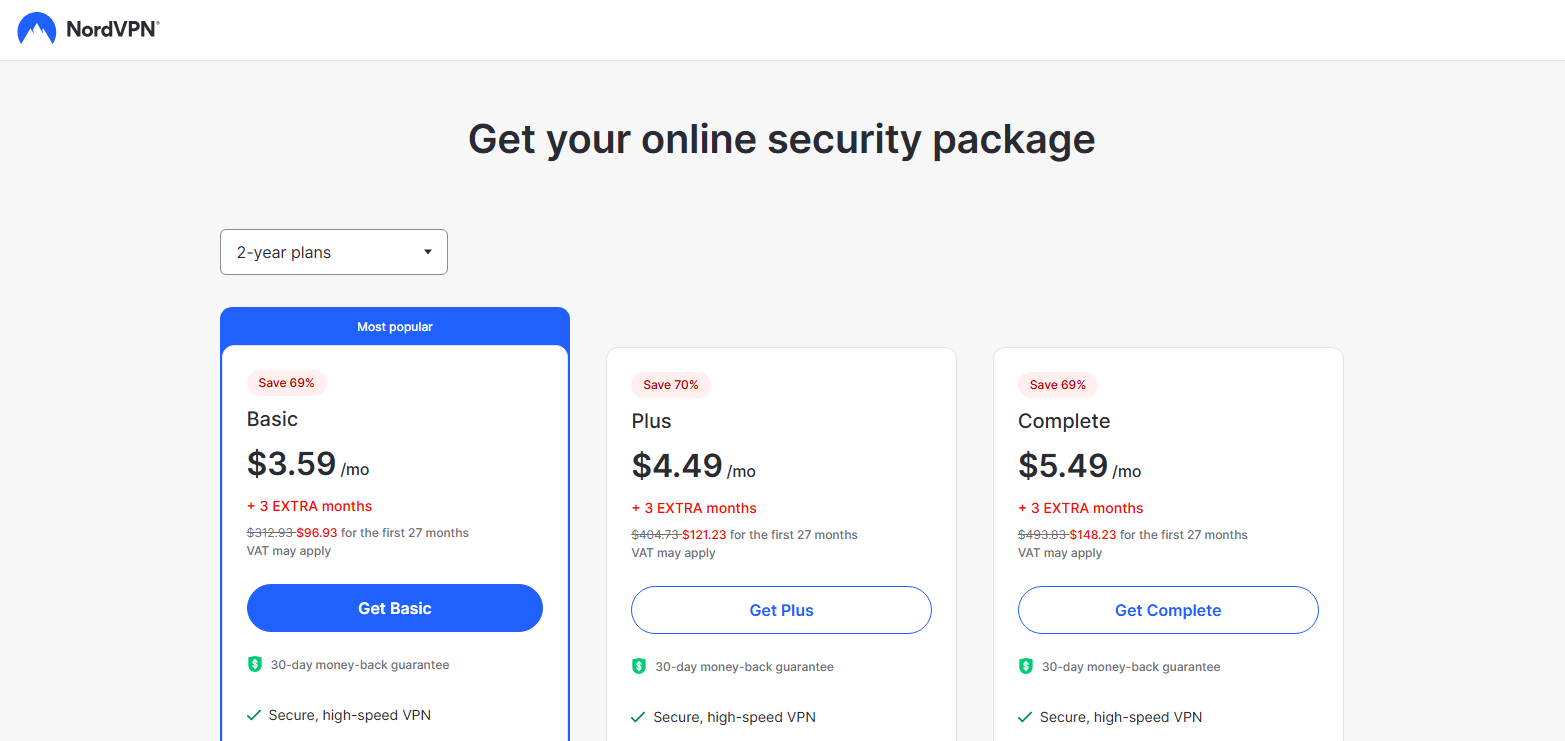

To learn more and start securing your online financial activities today, check out NordVPN and take the first step toward online safety.

By incorporating these tools into your security routine, you’ll significantly reduce the risk of cyberattacks, identity theft, and financial fraud. Stay vigilant, and always prioritize security when managing your finances online.