Running a business in 2024 isn’t just about innovation; it’s about finding smart ways to reduce costs while maximizing value. If you’re an entrepreneur, you know every penny counts—especially when scaling up or staying competitive.

Luckily, there are tons of ways to trim overhead without sacrificing quality or productivity. In this article, we’ll dive into practical money-saving hacks that every entrepreneur should keep in their arsenal.

From adopting cost-effective tools to leveraging cashback programs, we’ve got you covered.

1. Embrace Cloud-Based Software

One of the easiest ways to slash overhead is by switching to cloud-based software. Forget about hefty upfront costs for licenses or maintenance fees.

With cloud solutions, you only pay for what you use—whether it’s project management tools like Trello or accounting software like Xero. Not only do these platforms reduce IT costs, but they also offer flexibility to scale as your business grows.

Why It Works:

- No upfront costs or hardware investment.

- Automatic updates and security features are included.

- Scalable pricing based on your business needs.

2. Outsource Tasks to Freelancers

Hiring full-time employees can be costly, especially when you factor in benefits and insurance. Instead, consider outsourcing tasks to freelancers. Platforms like Fiverr or Upwork offer a wealth of talent at a fraction of the cost.

Whether you need a graphic designer, content writer, or digital marketer, outsourcing allows you to only pay for what you need, when you need it.

Outsourcing Benefits:

- Avoid long-term commitments and full-time salaries.

- Access specialized skills without the need for training.

- Scale your team up or down depending on your workload.

3. Cut Utility Costs with Energy-Efficient Solutions

Running an office means dealing with electricity, heating, and other utility costs. One way to reduce these expenses is by investing in energy-efficient appliances and lighting.

Simple upgrades like LED lights, smart thermostats, or motion-sensor switches can significantly lower your bills over time.

Energy Efficiency in Action:

- LED lights use up to 75% less energy than traditional bulbs.

- Smart thermostats optimize energy use based on your schedule.

- Rebates are often available for businesses that go green.

4. Use Free or Low-Cost Marketing Tools

Marketing doesn’t have to eat up a chunk of your budget. Plenty of free and low-cost marketing tools exist to help you promote your brand.

Canva is a popular design tool with a free version that allows you to create stunning social media posts, infographics, and presentations.

Mailchimp offers a free tier for email marketing, making it easier to keep your customers engaged without burning a hole in your wallet.

Get Creative Without Breaking the Bank:

- Free design tools make it easy to DIY your graphics.

- Email marketing platforms offer affordable ways to nurture leads.

- Social media scheduling tools like Buffer help you manage your campaigns efficiently.

5. Barter Services with Other Entrepreneurs

Sometimes, cash isn’t the only currency that matters. Bartering services with fellow entrepreneurs is an excellent way to save money. Let’s say you’re great at web design but need help with accounting.

Partner with someone who can offer that skill in exchange for your expertise. It’s a win-win for both parties, and no money has to change hands.

Why Bartering Works:

- Build mutually beneficial relationships with other entrepreneurs.

- Get professional services without adding to your expenses.

- Create a sense of community and support within your local business network.

6. Negotiate with Vendors and Suppliers

It never hurts to negotiate, especially when you’re working with long-term vendors. Whether it’s for office supplies, software licenses, or even rent, don’t shy away from asking for discounts or better terms. More often than not, suppliers are willing to offer discounts to loyal customers, but they won’t unless you ask.

Tips for Effective Negotiation:

- Be polite but firm when requesting better terms.

- Research your vendor’s competitors and use that info to leverage a better deal.

- Offer something in return, like a longer contract, for a price cut.

7. Leverage Cashback Programs to Offset Business Purchases

Cashback programs aren’t just for personal use. Many businesses overlook the potential savings that cashback platforms offer on everyday business expenses.

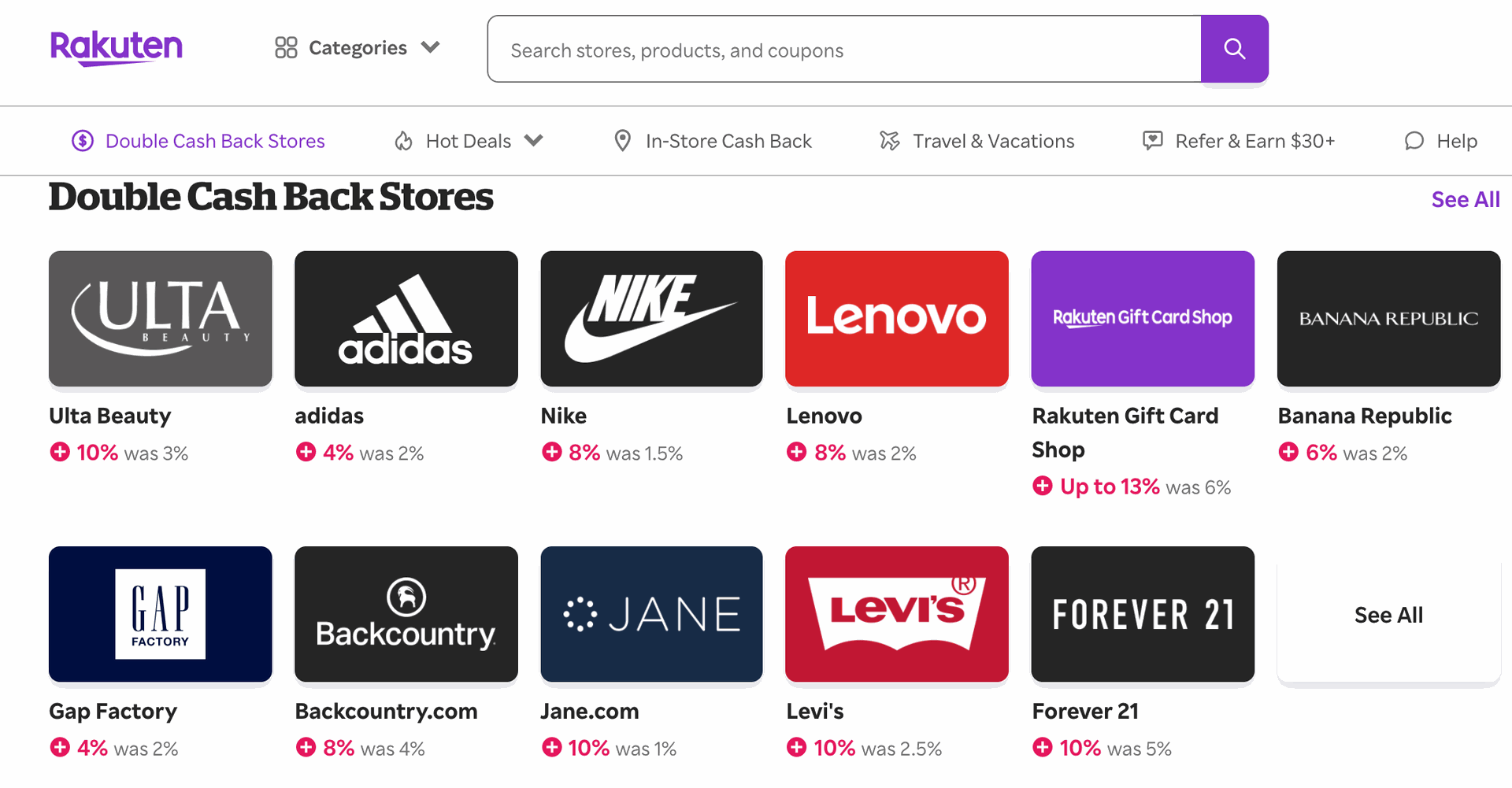

Whether you're buying office supplies, marketing services, or even travel expenses, cashback programs can save you a significant amount over time. This brings us to one of the most powerful tools for entrepreneurs—Rakuten.

Why Entrepreneurs Should Use Rakuten

Rakuten offers an excellent way for business owners to save on various purchases. With Rakuten, you can earn cashback on everything from office supplies to software subscriptions. It's a smart way to put money back into your pocket for things you're already buying.

Plus, Rakuten partners with thousands of retailers, giving you a wide range of options.

Benefits of Using Rakuten:

Cashback on Everyday Purchases: Whether you’re stocking up on office supplies or paying for cloud software, Rakuten helps you earn cashback effortlessly.

Exclusive Deals: Rakuten often features exclusive discounts and coupon codes for its users, allowing you to save even more.

Easy to Use: Simply sign up, shop through their platform, and start earning cashback without any complicated steps.

Maximize your business spending and earn money back by using Rakuten. Start saving today!