Navigating the financial landscape can be daunting, especially for millennials who are balancing the pressures of student loans, skyrocketing housing costs, and the desire to enjoy life now rather than later.

But here's the thing—financial planning doesn’t have to mean depriving yourself of the things you love. It’s all about finding smart ways to save, invest, and yes, even earn as you spend.

Understanding Your Financial Landscape

First things first, it’s crucial to get a clear picture of your financial situation. Start by listing all your income sources, including your primary job, side hustles, and any passive income streams.

Next, track your expenses. Break them down into fixed (rent, utilities, loans) and variable (eating out, entertainment, travel) costs. This exercise will help you see where your money is going and identify areas where you can cut back.

The Power of Budgeting

Once you know where your money is going, it's time to create a budget. But don't think of budgeting as a restrictive exercise.

Instead, see it as a tool to align your spending with your priorities. For millennials, this might mean setting aside money for travel, dining out, or new tech gadgets.

The key is to balance these wants with long-term financial goals like saving for a down payment on a house or building an emergency fund.

Consider the 50/30/20 rule:

Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. This simple strategy ensures you’re not only covering your essentials but also enjoying your life and securing your financial future.

Smart Saving Strategies

Saving money doesn’t have to be painful. Start by automating your savings. Set up automatic transfers to a high-yield savings account or an investment account each payday. This way, you’re paying yourself first without even thinking about it.

Another strategy is to take advantage of employer-sponsored retirement plans like a 401(k), especially if your employer offers a matching contribution. That’s free money on the table—don’t leave it behind.

And don’t forget about the little things. Skipping that daily $5 latte might seem insignificant, but over time, these small changes can add up to significant savings.

Investing: The Earlier, the Better

For millennials, time is on your side when it comes to investing. The earlier you start, the more time your money has to grow.

Consider low-cost index funds or exchange-traded funds (ETFs) that provide broad market exposure and have a track record of solid returns over time.

If you’re new to investing, start small. Many apps allow you to invest with as little as $5. As you become more comfortable, you can increase your contributions and diversify your portfolio.

Earning While You Spend

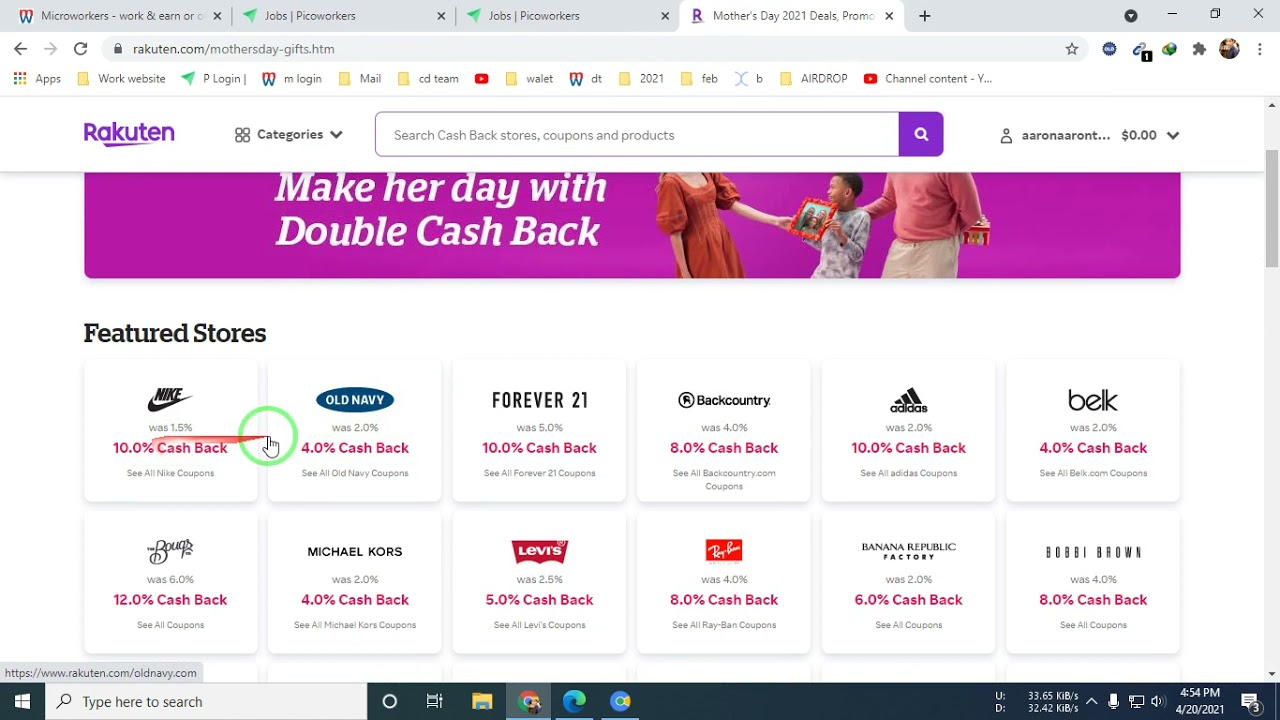

Now, let's talk about a concept that sounds almost too good to be true—earning money while you spend. This is where cashback programs come into play.

By using cashback methods or apps, you can earn a percentage of your spending back, essentially getting paid to shop.

The Art of Spending Wisely

While saving and investing are crucial, how you spend your money matters too. Being a smart consumer doesn’t mean being cheap; it means getting the best value for your money.

Look for discounts, compare prices, and use cashback apps to maximize your spending power.

Avoid impulse purchases by following the 24-hour rule. If you see something you want, wait 24 hours before buying it. Often, the initial excitement will wear off, and you’ll realize you don’t need it.

Side Hustles: Turning Your Skills into Cash

Millennials are the side hustle generation, and for a good reason. A side hustle can provide extra income, help pay down debt, or fund your savings goals.

Whether it’s freelance writing, graphic design, or selling handmade goods online, there’s no shortage of ways to turn your skills into cash.

Future-Proof Your Finances

Finally, think about the future. Life is unpredictable, and the best way to prepare for the unexpected is to have a solid financial plan.

This includes having an emergency fund, proper insurance coverage, and a long-term investment strategy.

Conclusion: How Rakuten Can Help You Save While You Spend

If you’re looking for an easy way to earn while you spend, Rakuten’s cashback program is a no-brainer. Rakuten partners with thousands of retailers, offering you cashback on your everyday purchases.

Whether you're shopping for clothes, electronics, or even booking travel, Rakuten gives you a percentage of your purchase back—essentially putting money back in your pocket.

Don't miss out on these savings—sign up for Rakuten and start earning cashback today. It’s a simple way to boost your financial game without any extra effort.