Imagine getting a portion of your spending back, every time you shop. Cashback apps have become incredibly popular as they let you save money without changing your spending habits. Especially now, when inflation and economic pressures are top of mind, cashback programs are a real game-changer, providing easy savings on everyday purchases.

According to recent studies, consumers who use cashback apps regularly can save hundreds of dollars annually just by shopping through these platforms.

In this article, we’ll take a deep dive into the best cashback apps for 2024, examining their features, benefits, and unique advantages.

One app stands out—Rakuten, which consistently ranks as one of the most user-friendly and rewarding options. By the end, you’ll have all the details you need to choose the best cashback app for your needs and see how Rakuten might be the right fit.

Why Use Cashback Apps?

Cashback apps are designed to make saving simple. By partnering with retailers, these apps offer a portion of your spending back as cash rewards. For many, cashback apps have become the go-to savings tool, eliminating the need to hunt down individual coupons or deals.

Types of Cashback

There are several types of cashback opportunities:

- Online Shopping: Cashback apps like Rakuten offer rewards when you shop at partner stores online.

- In-Store Rewards: Many apps now offer in-store cashback, where you earn by linking your purchases to the app.

- Linked Credit Card Offers: Some apps let you earn cashback automatically when you shop with a registered credit card.

- Special Promotions: Seasonal and event-based cashback boosts are also common, especially around holidays.

Rakuten, for instance, is well-known for its flexibility. Not only does it work seamlessly online, but its in-store cashback options and partnerships with top retailers make it versatile and user-friendly.

Key Criteria for Choosing the Best Cashback App

With so many cashback apps available, choosing the right one can be a bit overwhelming. Here are some of the most important criteria to consider:

- Ease of Use: Look for apps with an intuitive design and a straightforward earning process. After all, saving money shouldn’t be complicated.

- Variety of Partners: The more retailers and categories an app supports (from groceries to travel), the more opportunities you have to earn.

- Redemption Options: Check how you can cash out your rewards—via PayPal, direct deposit, or gift cards?

Rakuten checks all these boxes and more. With its simple interface and PayPal payout option, Rakuten makes it easy to earn and redeem cashback. It’s a popular choice for those who value convenience and flexibility.

The Top Cashback Apps & Sites for 2024 (with Pros and Cons)

Here’s a closer look at the top cashback apps to help you find the perfect match.

1. Rakuten

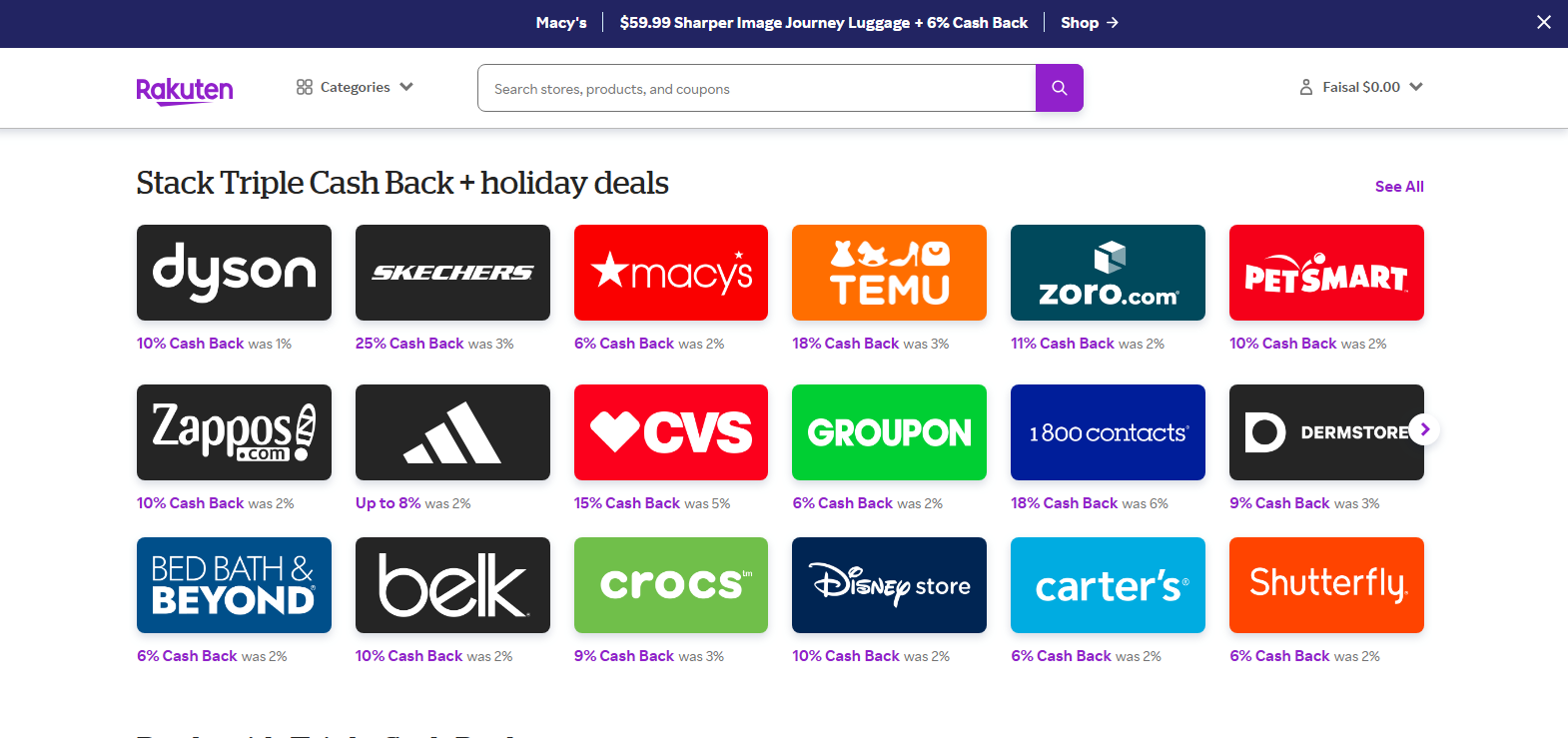

Rakuten leads the pack, thanks to its extensive retailer network and user-friendly platform. Here’s why it’s a must-try:

- Overview: With thousands of partner stores and generous cashback rates, Rakuten stands out as a top contender. You can earn rewards from major brands in categories like electronics, fashion, travel, and more.

- Pros: Large sign-up bonuses, easy-to-navigate interface, works for both online and in-store purchases.

- Cons: Cashback can take time to appear in your account, as purchases need retailer confirmation.

- Best For: Shoppers who want reliable cashback with high redemption options.

If you’re ready to start saving, you can try Rakuten by signing up here. With Rakuten, getting cashback on your usual purchases is as simple as clicking and shopping.

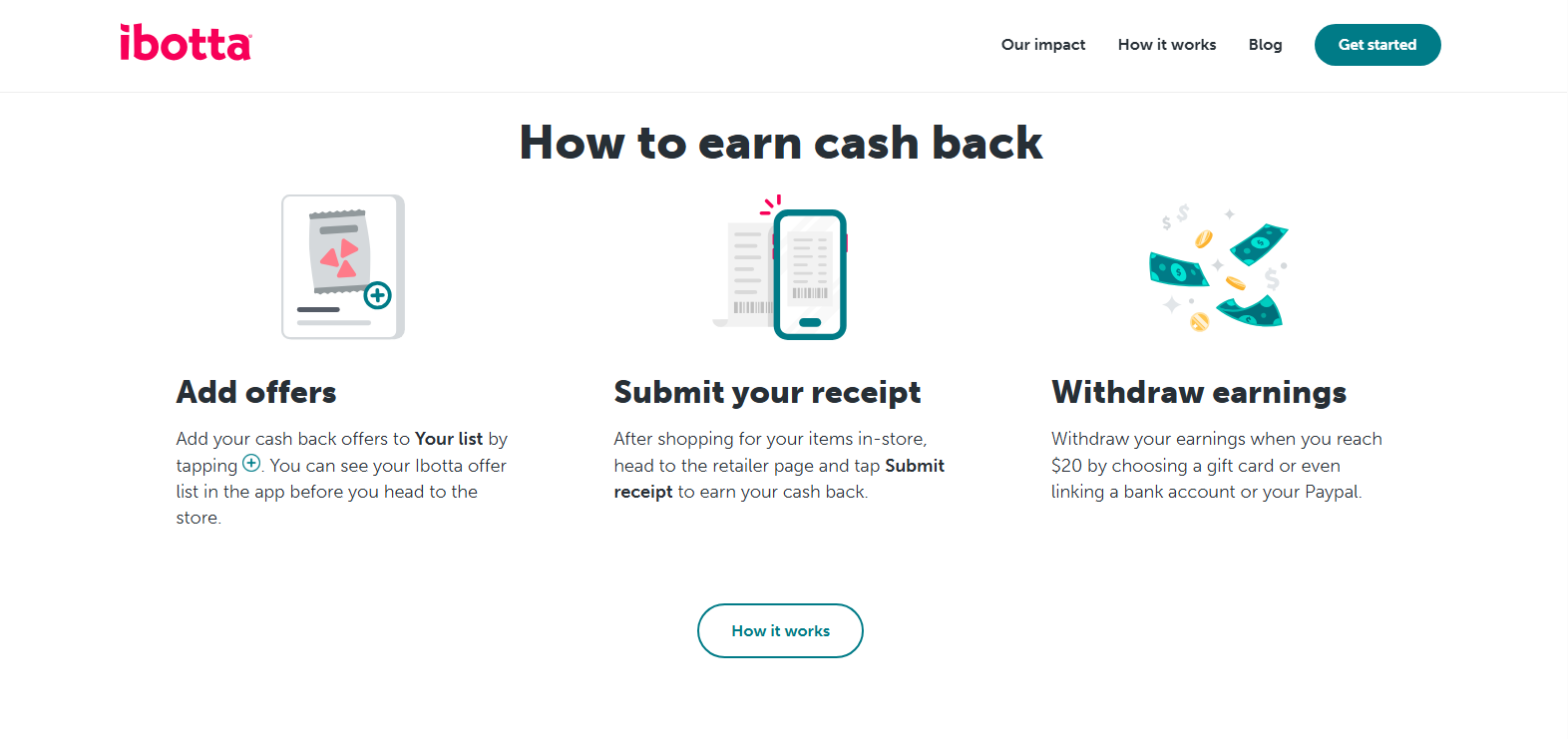

2. Ibotta

- Overview: Ibotta specializes in grocery cashback, making it ideal for regular supermarket shoppers.

- Pros: Strong cashback on grocery purchases, easy receipt-scanning feature.

- Cons: Limited online shopping options compared to other apps.

- Best For: Shoppers looking to save on groceries and everyday essentials.

3. Fetch Rewards

- Overview: Fetch app on receipt-scanning to earn points on all kinds of purchases.

- Pros: Simple and straightforward; no need to activate offers.

- Cons: Cashback value can vary widely depending on purchase category.

- Best For: Users who enjoy a quick, easy way to earn rewards by scanning receipts.

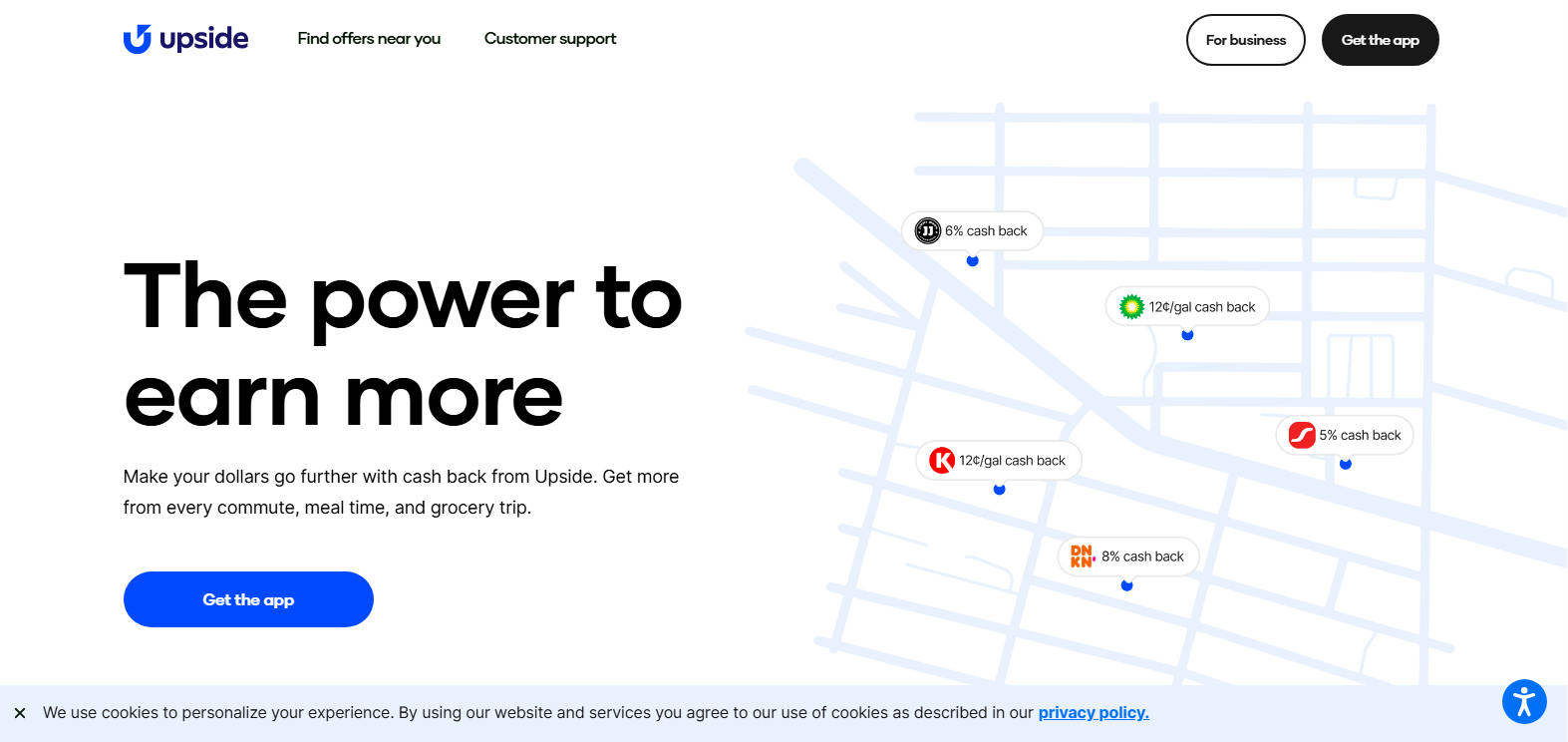

4. Upside

- Overview: Upside is geared towards gas and food savings, perfect for drivers who want cashback at the pump.

- Pros: Great for gas stations and select restaurants.

- Cons: Limited to specific categories like fuel and dining.

- Best For: Drivers and commuters looking for discounts on fuel and dining out.

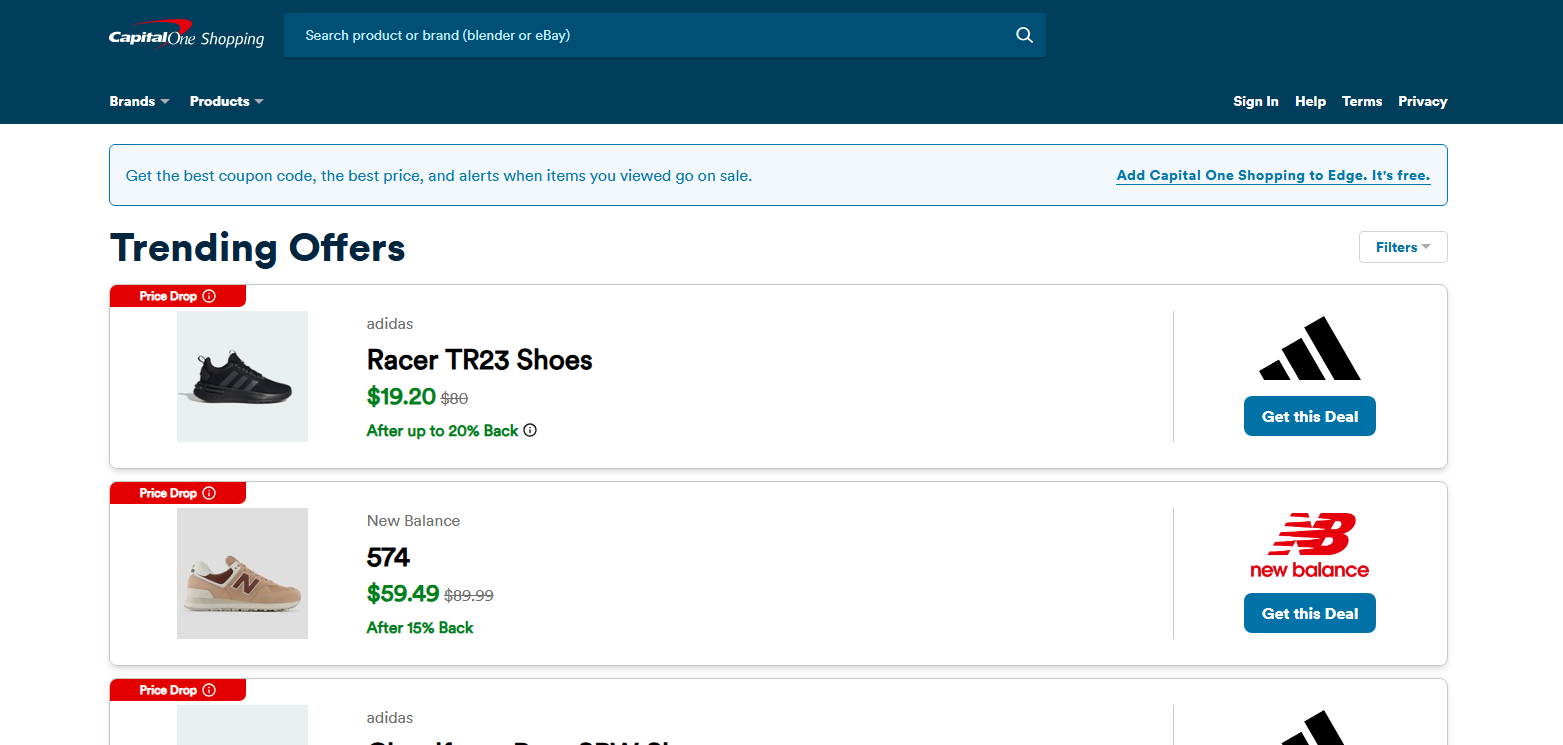

5. Capital One Shopping

- Overview: Primarily a coupon finder, Capital One Shopping offers price comparisons and cashback at select stores.

- Pros: Automatically applies coupons, ideal for online shoppers.

- Cons: Limited to online retailers; not available for in-store purchases.

- Best For: Bargain hunters who want both cashback and discounts.

How to Maximize Your Cashback Savings

Even with the right app, knowing a few tricks can help you boost your cashback earnings.

Stacking Opportunities

Some credit cards offer cashback, and you can layer this with cashback apps to double your savings. For example, if you use a cashback credit card to make a purchase through Rakuten, you’ll earn rewards from both sources.

Special Promotions and Seasonal Deals

Many cashback apps run higher cashback rates during the holidays or for special events. Rakuten frequently has seasonal promotions, offering elevated cashback rates on brands and categories that matter most. Keep an eye out to maximize your savings.

Referral Bonuses

Most cashback apps have referral bonuses, and Rakuten’s program is particularly rewarding. By sharing your referral link with friends and family, you can earn extra cashback each time they make a qualifying purchase.

How to Choose the Right Cashback App for Your Needs

Choosing the best cashback app for you really depends on your spending habits. Here are a few tips:

- Identify Your Spending Habits: Are you a frequent online shopper? Or do you spend more on groceries and gas? Select an app that aligns with where you shop the most.

- Ease of Cash Out: Some apps, like Rakuten, allow easy cash-outs through PayPal. This quick access to your funds can be a big plus.

- User Experience: Prioritize apps with a design that’s easy to navigate. Rakuten’s intuitive platform helps you earn cashback with minimal hassle, making it a favorite for users who want a smooth experience.

Conclusion

Cashback apps have taken the hassle out of saving money and made it easier to enjoy cashback on purchases you’re already planning to make. Whether it’s everyday essentials, holiday gifts, or dining out, cashback apps can help you put a little money back in your pocket.

Rakuten, as we’ve seen, offers a top-notch experience with its wide range of partner stores, seasonal promotions, and versatile redemption options.

If you’re new to cashback apps or looking to maximize your savings, Rakuten’s user-friendly platform, extensive retailer network, and reliable cashback make it a smart choice for 2024.

Ready to give it a try? Signing up is easy, and you’ll be on your way to earning rewards in no time. Explore Rakuten here and start seeing the savings add up with every purchase!

Q1: What is a cashback app, and how does it work?

A cashback app rewards users for purchases at partner retailers by offering a percentage back. Simply activate offers in the app or browser extension, make purchases, and watch your cashback accumulate for easy redemption.

Q2: Are cashback apps safe to use?

Yes, cashback apps like Rakuten, Ibotta, and Dosh are generally safe, as they use encryption to protect user data. However, they collect purchasing data to enhance targeted offers, so privacy-conscious users should review policies carefully.

Q3: How do I earn cashback with Rakuten?

Sign up on Rakuten, activate cashback offers through their website or browser extension, and shop as usual. Rakuten automatically tracks eligible purchases, crediting your cashback to your account for easy payout options.

Q4: Which cashback app is best for grocery shopping?

Ibotta is a top choice for grocery shopping. It allows users to scan receipts or activate offers for grocery items, earning cashback at various retailers and sometimes offering bonuses on specific products.

Q5: How does the Honey cashback extension work?

Honey automatically applies coupon codes during online purchases, saving users money and adding cashback points redeemable for gift cards. The browser extension is easy to install and works with thousands of retailers.

Q6: Can I use multiple cashback apps for one purchase?

Yes, many users layer cashback apps like Drop, Rakuten, and Dosh by combining their rewards for one purchase. However, review each app’s terms, as some may restrict stacking with other offers.

Q7: How does cashback differ from points?

Cashback offers a percentage of your purchase as money back, whereas points accumulate to redeem for gift cards or other rewards. For example, Drop awards points for purchases, which can be converted to rewards.

Q8: Are there cashback apps for in-store purchases?

Yes, apps like Dosh and Upside support in-store cashback. Dosh links to your payment card to offer cashback at select stores automatically, and Upside provides cashback at gas stations and restaurants through partner offers.

Q9: What is a minimum payout threshold?

Many cashback apps require a minimum balance to cash out. For instance, Ibotta requires a $20 balance to redeem cashback, while others may have lower or higher thresholds depending on the service and payout options.

Q10: Are cashback apps worth it?

Cashback apps are beneficial for frequent shoppers, allowing easy savings. By combining different apps based on your shopping habits, you can maximize rewards, making them worthwhile for everyday and essential purchases.

If you want to know about The Step-by-Step Guide to Setting Up Your Own Website, Then Click Here.